An M&A firm in Spain was preparing for a merger and needed to conduct a deep risk assessment. Their challenge was identifying hidden risks, evaluating corporate reputation, and ensuring a comprehensive due diligence process beyond traditional methods. With multiple stakeholders and limited time, they sought an efficient way to analyze financial, media, and risk factors.

To streamline their investigation, they used Golden Owl’s intelligence solutions, allowing them to uncover critical insights that could impact the merger.

The firm followed a structured approach, using Golden Owl’s collectors and analytical tools to gather and interpret essential data.

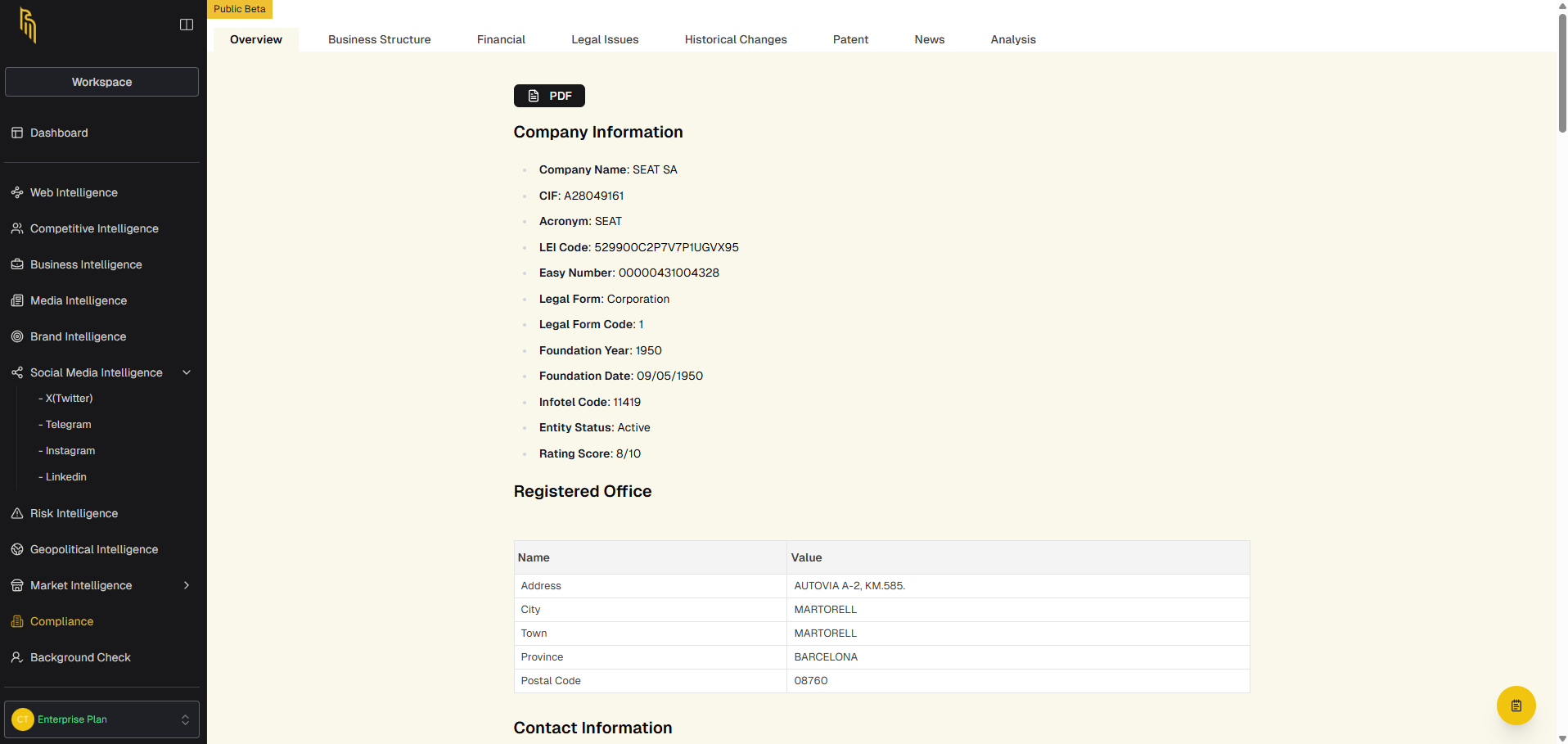

One of their primary concerns was obtaining a reliable financial overview of the target company. They used Golden Owl’s Compliance Collector to retrieve:

Challenge: Ensuring the accuracy and completeness of financial records while expanding the analysis beyond conventional business reports.

Outcome: They received a full compliance report within minutes, featuring ready analysis and insights into financial stability and potential risks, seamlessly integrable with other collectors for a comprehensive assessment.

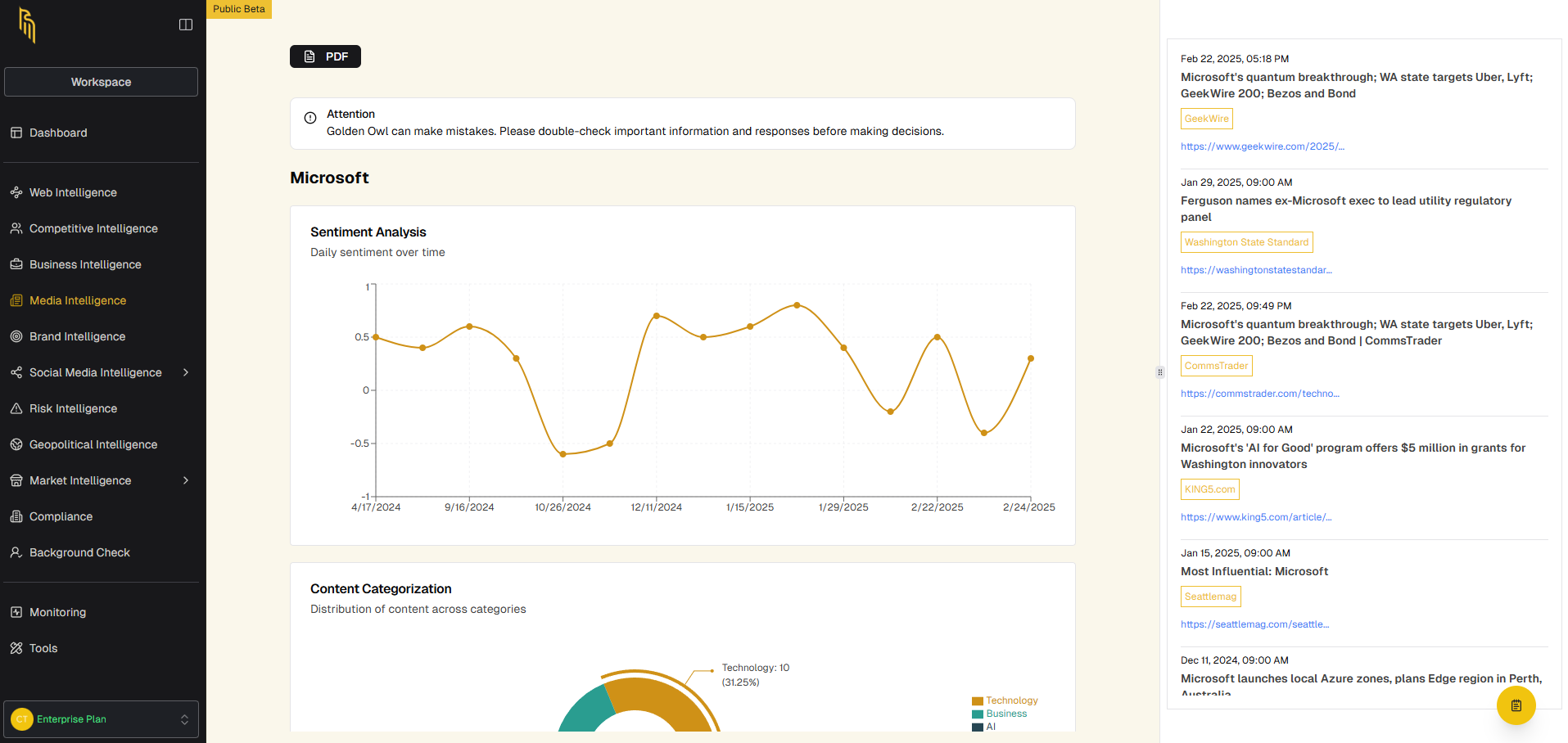

Public perception was another key concern, as past media reports could indicate potential risks. The firm created Media Intelligence Collectors to analyze:

Challenge: Sifting through massive amounts of media data while ensuring they didn’t overlook critical reports.

Outcome: They obtained a structured media analysis highlighting reputational risks and previously unnoticed concerns.

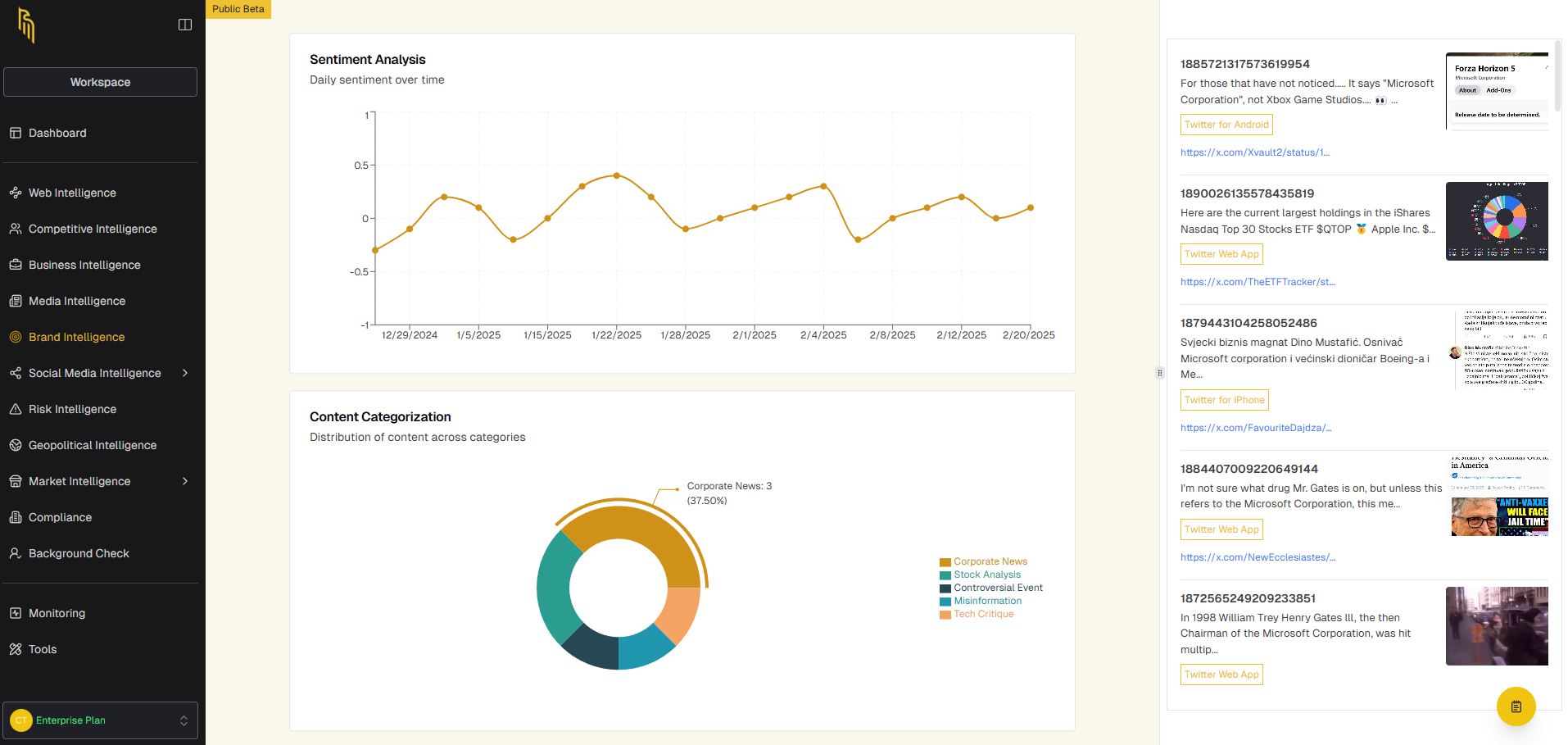

The firm needed to assess how the company was perceived online, especially in social media discussions. They created Brand Intelligence Collectors to analyze:

Challenge: Differentiating between minor concerns and potential reputation risks that could affect the merger.

Outcome: In under two minutes, they received a brand perception report with raw data included, helping them understand how the company was viewed by the public and industry peers.

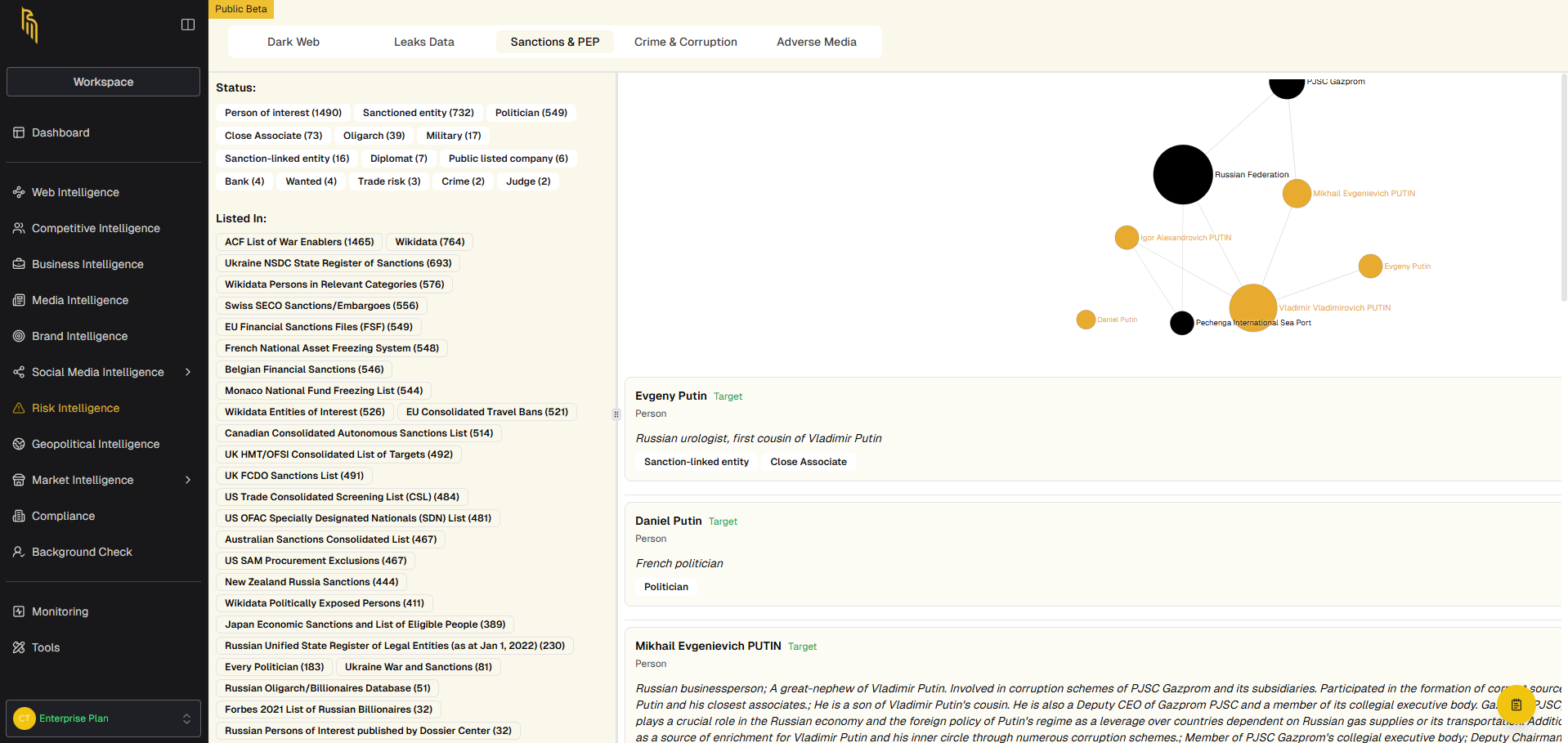

Hidden risks such as leaked information, regulatory violations, or undisclosed connections were a major concern. They used the Risk Intelligence Collector to scan:

Challenge: Ensuring they weren’t missing critical risk factors that could compromise the deal.

Outcome: The firm uncovered unexpected risks, including leaked employee data and mentions in legal disputes that had not been disclosed.

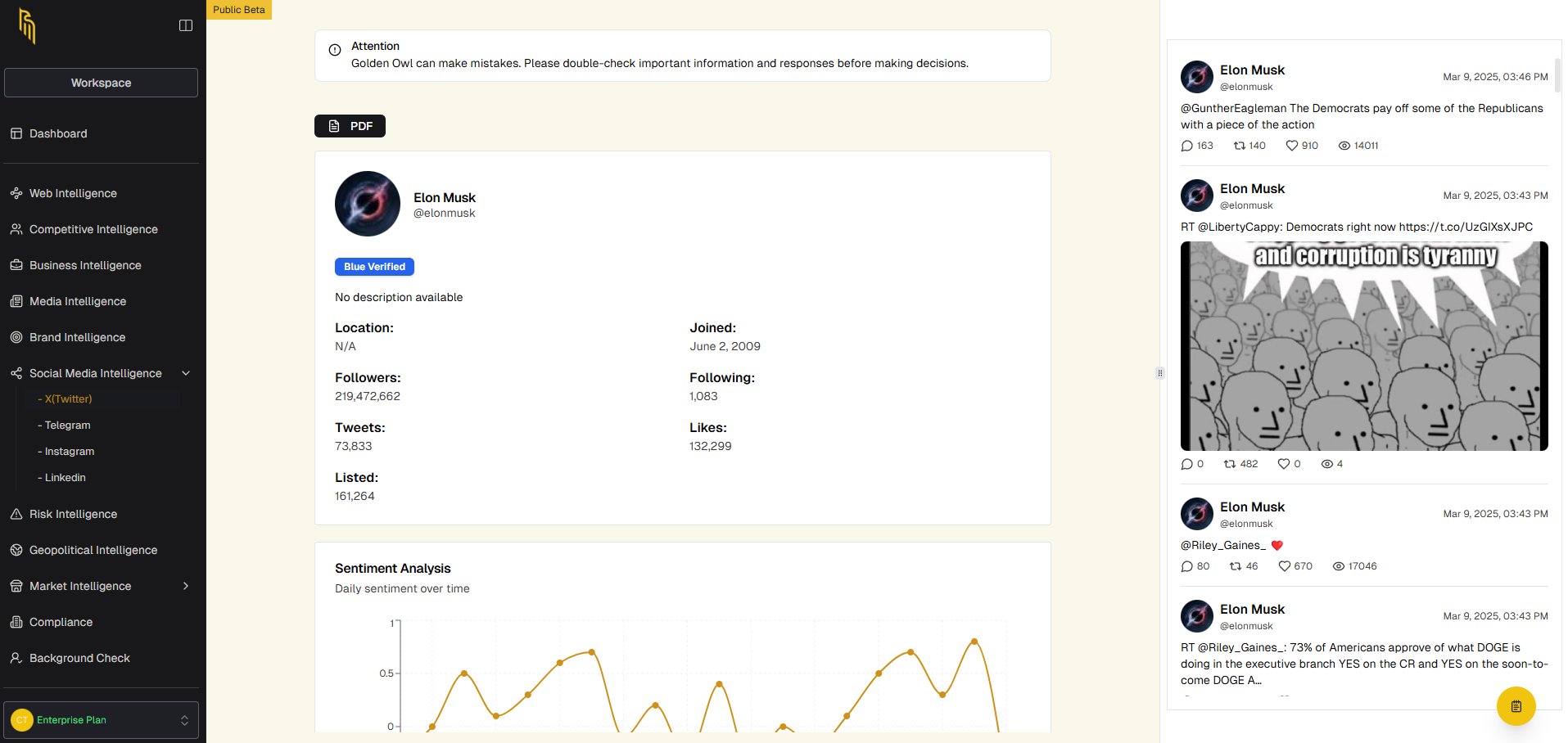

To ensure they had a complete understanding of key individuals, the firm created Social Media Intelligence Collectors to analyze:

Challenge: Finding relevant data quickly without manually searching different platforms.

Outcome: They identified potential concerns in executive communication patterns and engagement trends that required further review.

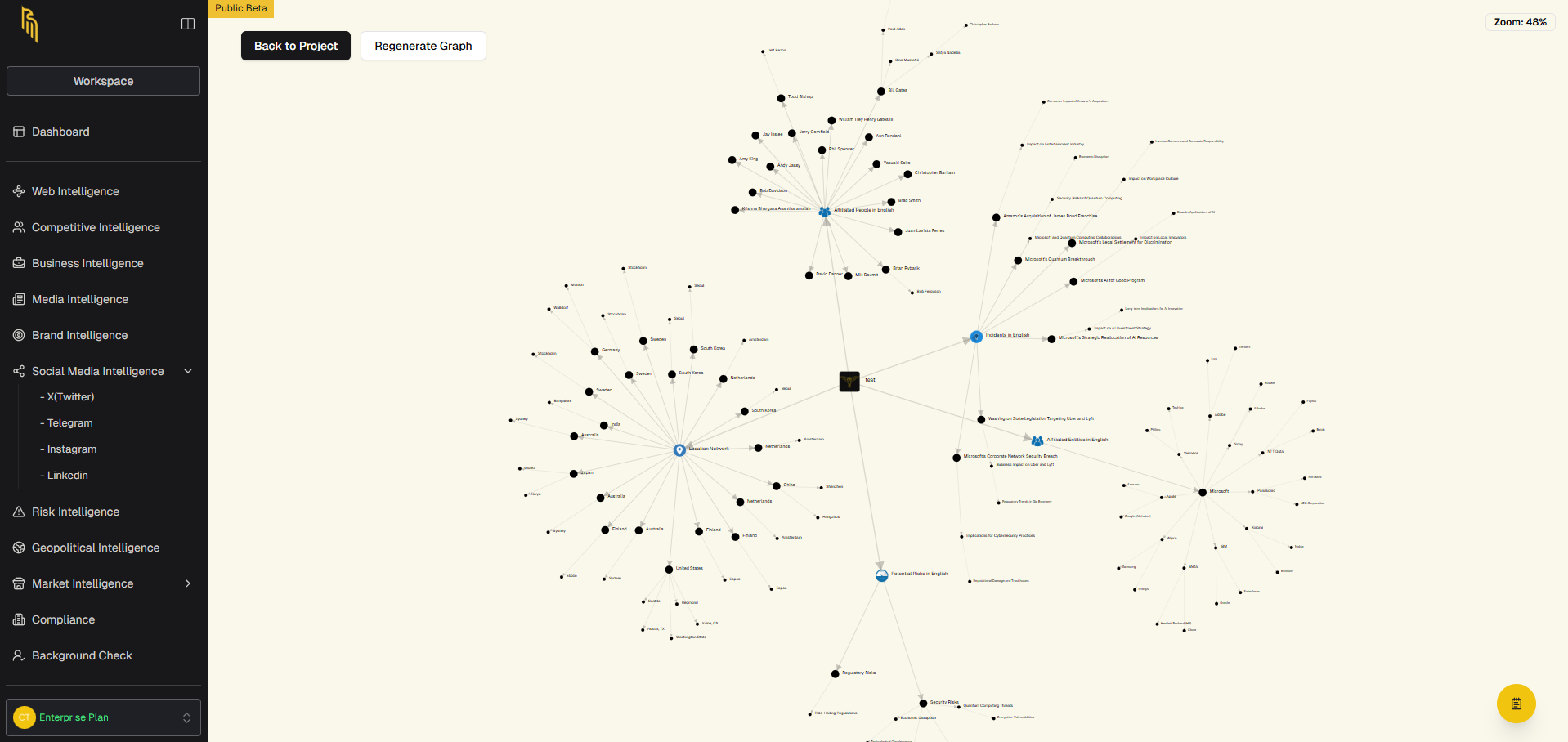

With large amounts of collected data, the firm needed a structured way to analyze relationships and connections. Using Golden Owl’s AI Engine, they:

Challenge: Ensuring they could seamlessly connect financial data, media insights, and hidden relationships while minimizing manual effort and the risk of human omission.

Outcome: The firm uncovered previously unknown affiliations/engagements and received a comprehensive risk intelligence report, revealing hidden vulnerabilities.

Within 30 minutes, the firm achieved:

The firm continues to integrate Golden Owl’s intelligence tools for ongoing risk monitoring and future M&A transactions.

By using Golden Owl’s intelligence solutions, the M&A firm significantly enhanced its due diligence process, allowing them to:

Golden Owl’s platform enabled the firm to conduct a thorough, efficient, and proactive risk analysis, ensuring they had all necessary insights before finalizing the merger.